SKYX Platforms Corp. (SKYX:NASDAQ) is a company whose time has not yet come, but it is about to. The company has developed technologies that are set to revolutionize the smart home and lighting industries. One of the aspects of the technologies enables safe, super fast, and easy interconnectivity of smart home devices, electrical appliances, light fixtures, and ceiling fans.

It is laughable and ridiculous that after all the technological progress of the past 100 - 150 years, which includes such things as being able to hold thousands of photographs in the palm of your hand in a flash drive, you still have to climb up on a sometimes rickety stepladder and mess about with a screwdriver and wire cutter to install a light fitting with the ever-present danger of being electrocuted if some fool turns the power on.

If the same progress had been made in the field of photography, you would still have guys turning up with a big tripod and a massive camera on it with a hood and asking you to sit still on the sofa for 15 minutes to have your photograph taken. Installing light fittings and other devices continues to be a dangerous and unnecessary hassle, but the products that SKYX Platforms has developed will do away with all that and make the process remarkably simple and fast and drag this industry from the 19th century straight through the 20th and into the 21st century — in a nutshell, it boils it all down to "plug (it in) and play."

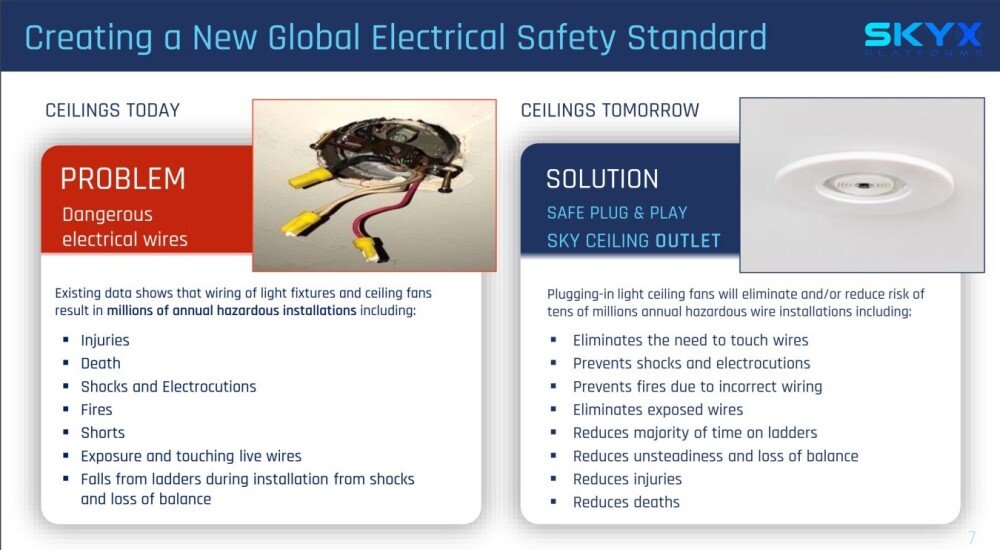

What a joke — almost 150 years after the light bulb was invented in the time of Edison in about 1880, people are still messing around up on ladders with wire cutters as in the picture on the left of the slide below, which is page 7 of the company's latest investor deck, but with SKYX's plug and play technology the process is easy and fast as shown on the right.

The following slide shows the enormous improvements afforded by the company's Safe Plug and Play Sky Ceiling Outlet.

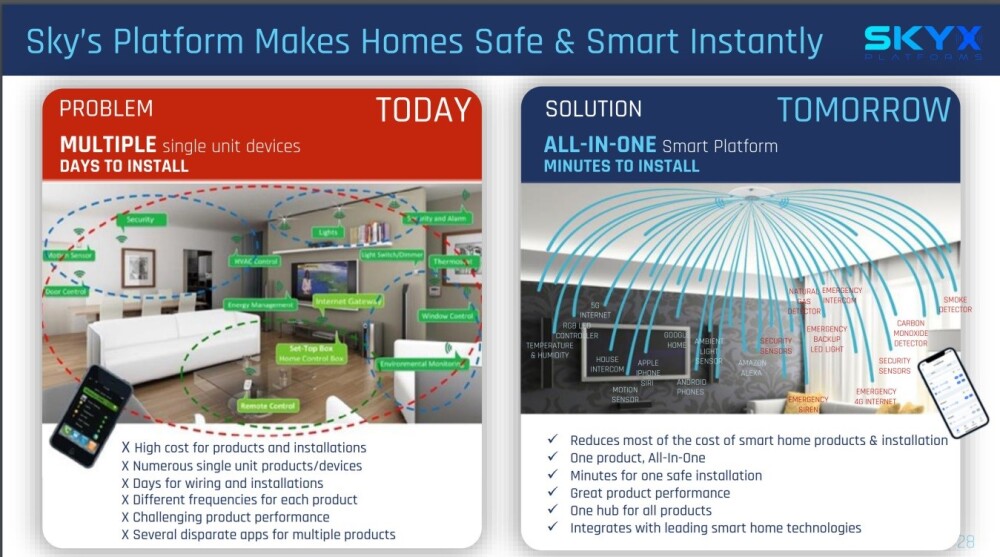

But the company's highly innovative products extend way beyond light fittings as the light fittings themselves can be transformed into Smart Platforms, as shown in the slide below, with the latest Ceiling Platforms having the capacity to make homes smart in a matter of minutes, with smart meaning the seamless interconnectivity of all devices.

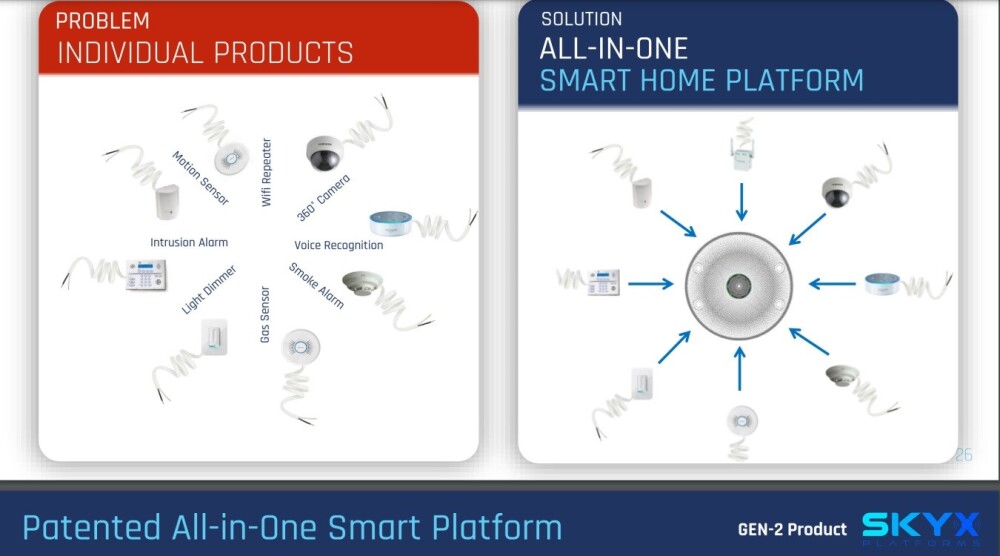

and the SKYX patented all-in-one Smart Platform means that you can transform the situation shown on the left in the slide below, where you have loads of independent devices that have to be installed and configured separately, to what you see on the right picture where they are integrated into and operate out of the Smart Platform.

Instead of loads of devices scattered all over the place, which is the current state of affairs, they are all integrated into one SKYX Smart Platform, as shown in this slide.

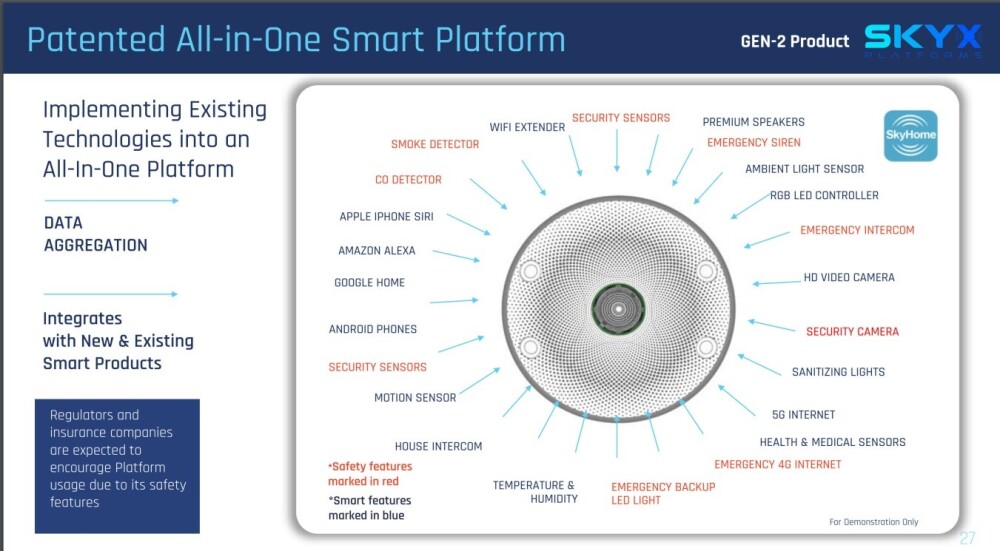

As shown below, the Smart Platform can handle pretty much anything.

If the company's products are so great and the market for them so potentially enormous, then why, you might fairly ask, is its stock languishing at such a low level after a severe bear market?

The answer lies with the capital markets and the usual hoops that a company has to jump through with respect to the regulatory authorities to prove up and license products, etc., and then the market has to be made aware that the products exist and gain sufficient motivation to switch to using them.

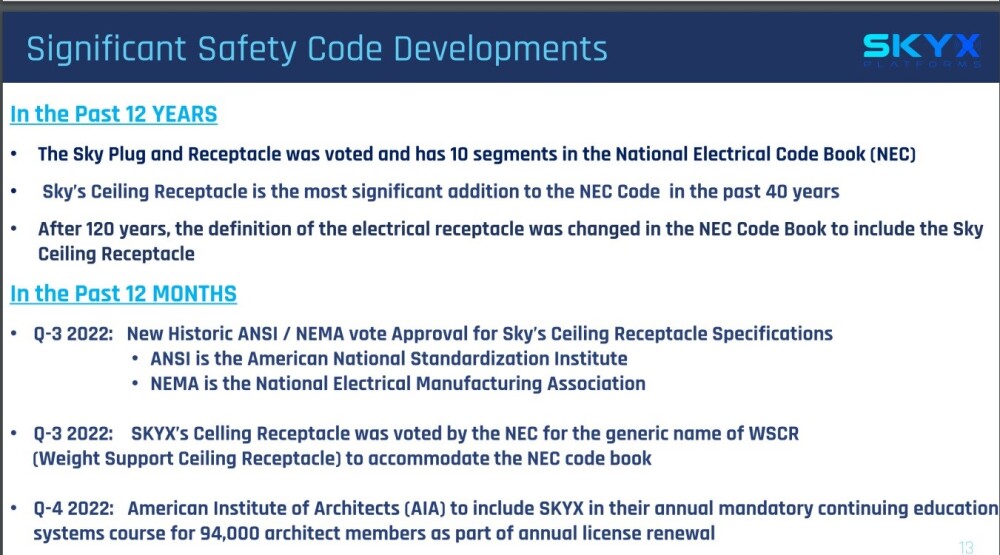

With respect to the former, the company is believed to have succeeded in clearing all of the hurdles. The following slide shows the significant safety code developments.

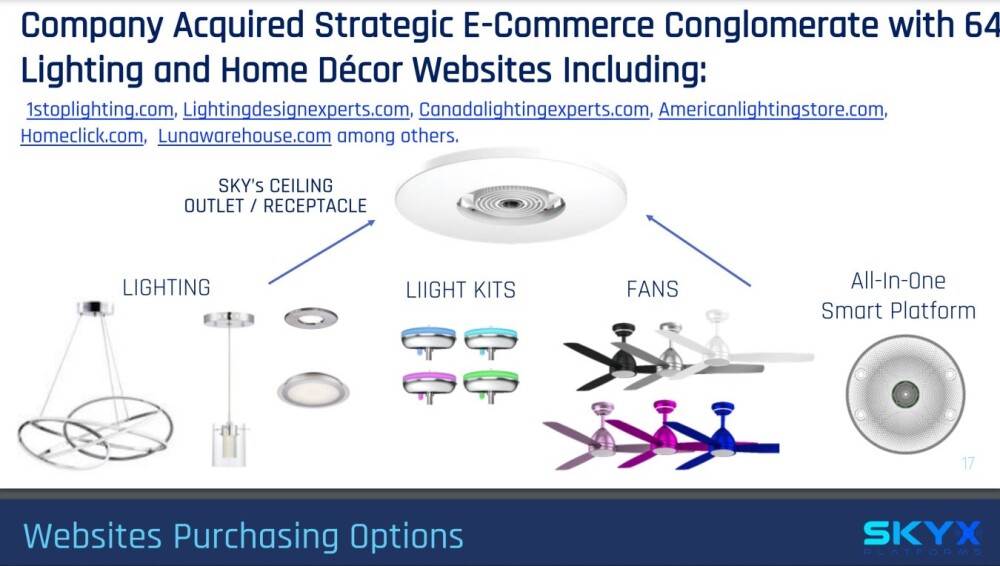

With respect to the latter, the company has acquired a strategic e-commerce conglomerate with 64 lighting and home decor websites, as the following slide shows, which will obviously be in the vanguard of promoting the company's products and bringing them to the attention of consumers and in the writer's view they provide such huge and obvious advantages that they will almost sell themselves.

The company's mission is set out on the following slide, which shows how the company is set to revolutionize the lighting and smart home industries.

Lastly, with respect to the fundamentals, it is worth reading the part of the news article "4 Stocks Poised To Pop With The AI Surge" that is devoted to SKYX, from which the following two relevant paragraphs have been lifted because they make clear that the company is not in financial difficulties.

"Financially robust, SKYX boasts [US$24.4 million in cash, cash equivalents, restricted cash, and investments, providing a solid foundation for growth and innovation as of September 30, 2023]. The renewal of a five-year global licensing master service agreement with GE Technology Development, Inc. further amplifies SKYX's reach and influence in the industry, enabling effective monetization of its technologies while safeguarding intellectual property rights.

At CES 2024, SKYX unveiled its patented All-In-One Smart Platform, a groundbreaking solution designed to transform homes into smart living environments seamlessly. This comprehensive platform integrates scheduling, energy-saving modes, and emergency functionalities, offering unparalleled convenience and efficiency.

In addition to its technological advancements, SKYX's commitment to safety and innovation extends to its proprietary patented platform technologies for smart home and electrical installations. Notably, SKYX's Sky Plug-Smart technology revolutionizes electrical installations with its "plug and play" installation of weight-bearing electronics, significantly simplifying and enhancing safety standards."

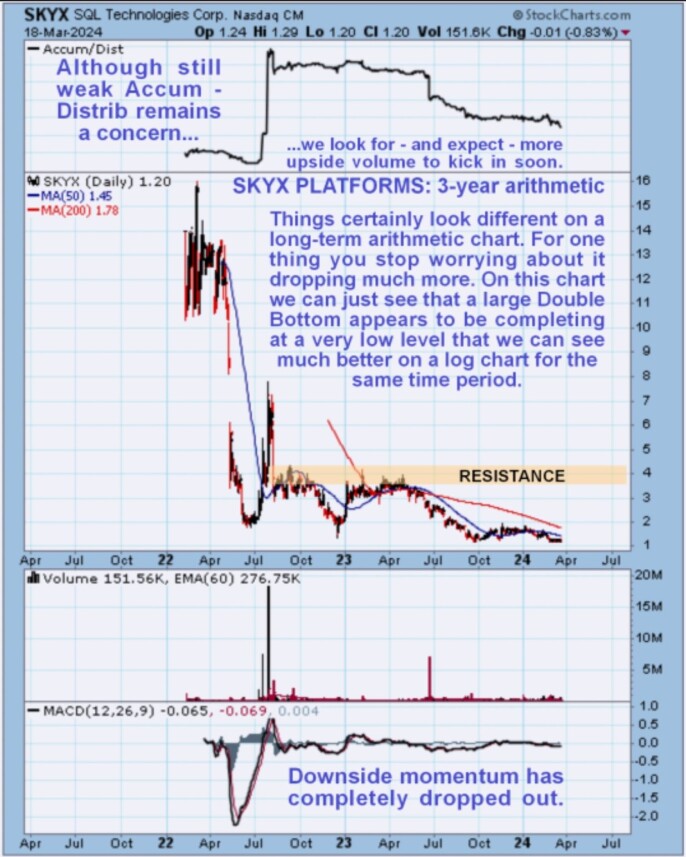

Now, we will review the stock charts for SKYX Platforms to see why it looks like such a compelling investment. We will start with a 3-year arithmetic chart, which shows it has been bumping along the bottom after the severe bear market of the past two years. It is now less than 10% of its price two years ago, which is why, given its exceptional fundamental prospects that continue to improve, it is viewed as an exceptionally attractive investment here.

The Accumulation line is still weak and we want — and expect to see — more upside volume kicking in soon. Two potentially strongly bullish points to note are that downside momentum, as shown by the MACD indicator, has completely dropped out, which is a common prerequisite for a new bull market to begin, and the other is that the price and its moving averages are drawing closer together.

While it is true that moving averages are in bearish alignment and thus could force a break lower, it is equally true that their proximity could lead to the price doing an "about face" soon and busting through them. Because this arithmetic chart flattens out recent price action, making it hard to see what has been going on in recent months, we will now look at a log chart for the same time period, which has the effect of opening out the price action at low levels.

On the 3-year log chart, we can much more easily see how the price is right now, making a potential Double Bottom with its lows of last September. Whilst there is some concern that the still falling moving averages will force a break lower, especially as the Accumulation line is still weak, this is belied by the very positive fundamentals of the company with the strong uptrend in revenues of the past several quarters thought likely to continue, so the results due out in April could act as a catalyst that triggers a reversal to the upside.

So if it does break lower short-term, it is considered likely that such a move will be a false breakdown or so-called head fake that will soon be followed by a reversal to the upside. As mentioned above, we are looking for — and expect to see — more upside volume kick in going forward.

The 1-year chart shows the Double Bottom pattern in detail. On this chart, we can see how the still bearishly aligned moving averages forced a break lower intraday yesterday, but the price recovered and closed at the support, as we will soon see on the 6-month chart.

Whilst still on the defensive this is a situation where the price could suddenly flip to the upside, ideally on a marked increase in volume.

Lastly, we will take a quick look at the 6-month chart on which we see how the price broke lower intraday yesterday but then hopped back up to close on the support, leaving behind a "bull hammer" on the chart that could mark the final low.

The point to keep in mind is that even if we haven't just seen the final low, we should be very close to it, and investors and would-be investors should watch for an increase in upside volume, especially as we approach the release of the latest results from the company.

Finally, and on a personal note, I am amazed, given what this company has already accomplished and created and given the truly enormous market for its products worldwide, that its stock is still at this low price — I don't think it will be down here for much longer.

SKYX Platforms' website.

SKYX Platforms Corp. closed at US$1.29 on March 21, 2024.

Want to be the first to know about interesting Technology investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter.

Subscribe

Important Disclosures:

- SKYX Platforms Corp. has a two-year consulting relationship with Street Smart, an affiliate of Streetwise Reports, and pays US$84,000 per year in stock for such services.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of SKYX Platforms Corp.

- Author Certification and Compensation: [Clive Maund of clivemaund.com] is being compensated as an independent contractor by Street Smart, an affiliate of Streetwise Reports, for writing this article. Maund received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in this content accurately reflect the personal, independent, and objective views of the author regarding any and all of the designated securities discussed. No part of the compensation received by the author was, is, or will be directly or indirectly related to the specific recommendations or views expressed

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks can only be construed as a solicitation to buy and sell securities when they are subject to the prior approval and endorsement of a Registered Securities Advisor operating in accordance with the appropriate regulations in your area of jurisdiction.